DCC - service de crédit décentralisé

Today, we'll be talking about one of the most popular projects starting this summer: Distributed Credit Channels (DCC). The main goal and purpose of this decentralized financial system is to combine service providers and users who need credit. This platform is built on the basis of the best locking technologies and is available to all inhabitants of the planet.

.png)

What is DCC?

Distributed Credit Chain (DCC) is the first publicly distributed blockchain in the world with the goal of establishing a decentralized ecosystem for financial service providers around the world. By strengthening channel credit technology and restoring people's rights, MISSIO Distributed Credit Chain must change different financial scenarios and achieve inclusive financing.

Distributed Credit Chain (DCC) is the first publicly distributed blockchain in the world with the goal of establishing a decentralized ecosystem for financial service providers around the world. By strengthening channel credit technology and restoring people's rights, MISSIO Distributed Credit Chain must change different financial scenarios and achieve inclusive financing.

DCCID is a decentralized account system, and its generation does not depend on any individual DCC node. Anyone, organization, or company can generate this DCCID offline. Only the information to be associated with DCC can be stored in the DCC ecosystem.

Benefits of the contribution of the ecosystem.

As an important indicator of the value of the contribution to the ecosystem, when a DCC-based financial system is in crisis, the amount of DCC (value of the contribution) can serve as a reference for preferential enjoyment of financial support participants in the ecosystem.

Use of DCC in the distributed credit chain.

Rebuilding Credit Costs with DCC As part of doing business, various participants do not need to pay attention to CCD price performance in the secondary market; instead, they may decide to use the service by simply evaluating the corresponding legal value of the service. Such a mode will transform the original way in which data institutions generate revenue, that is, make a profit by collecting and reselling user data to provide better services to customers. DCC's labor market is maintained on the basis of DC's contract agreement, which is responsible for recording, modifying and eliminating DCC's calculated compensation from service providers in the distributed credit chain. . Credit institutions must also pay CCD to the certification body when verifying the validity of the data. In the DCC system, people who need data or reports from data institutions must pay CCD. It recommends the most appropriate partner to individuals or institutions through AI analysis in the chain, effectively maintaining market fairness and transparency.

Use CDC to redistribute the benefits of the ecosystem. A portion (eg, 50%) is allocated to the establishment of data based on the usage weight of the data verification service by the credit institutions as an audit fee; a certain proportion (say 2.5%) will enter the credit rewards pool for that day as a loss of credit incentive; another part (eg 7.5%) is recycled and used for continuous release of DCC; the remaining portion (for example, 40%) is distributed as a credit score reward.

Use DCC to stimulate credit accumulation. In the DCC system, part (eg, 2.5%) of the loan in the application process is converted into a day credit pool and forms the total rewards pool with fixed incentives for the ecosystem. In addition, different types of reward pools will be formed in different companies in the future, and ecosystem participants may receive incentives for different pools when they use and contribute to different ecosystems.

Cross-border credit information. Because the DCC system offers cross-border credit, cross-scenario and cross currency credit for digital assets, DCC can match values from different loan jurisdictions in various countries, which greatly facilitates the multinational activities of lending agencies . Being more frequently used, DCC is expected to become the anchor currency of the multi-national lending ecosystem on the distributed credit chain and open the value exchange of ecosystem service providers in various countries. With DCC, users in one country or scenario will be able to purchase data reports from data providers in another country or scenario,

As an important indicator of the value of the contribution to the ecosystem, when a DCC-based financial system is in crisis, the amount of DCC (value of the contribution) can serve as a reference for preferential enjoyment of financial support participants in the ecosystem.

Use of DCC in the distributed credit chain.

Rebuilding Credit Costs with DCC As part of doing business, various participants do not need to pay attention to CCD price performance in the secondary market; instead, they may decide to use the service by simply evaluating the corresponding legal value of the service. Such a mode will transform the original way in which data institutions generate revenue, that is, make a profit by collecting and reselling user data to provide better services to customers. DCC's labor market is maintained on the basis of DC's contract agreement, which is responsible for recording, modifying and eliminating DCC's calculated compensation from service providers in the distributed credit chain. . Credit institutions must also pay CCD to the certification body when verifying the validity of the data. In the DCC system, people who need data or reports from data institutions must pay CCD. It recommends the most appropriate partner to individuals or institutions through AI analysis in the chain, effectively maintaining market fairness and transparency.

Use CDC to redistribute the benefits of the ecosystem. A portion (eg, 50%) is allocated to the establishment of data based on the usage weight of the data verification service by the credit institutions as an audit fee; a certain proportion (say 2.5%) will enter the credit rewards pool for that day as a loss of credit incentive; another part (eg 7.5%) is recycled and used for continuous release of DCC; the remaining portion (for example, 40%) is distributed as a credit score reward.

Use DCC to stimulate credit accumulation. In the DCC system, part (eg, 2.5%) of the loan in the application process is converted into a day credit pool and forms the total rewards pool with fixed incentives for the ecosystem. In addition, different types of reward pools will be formed in different companies in the future, and ecosystem participants may receive incentives for different pools when they use and contribute to different ecosystems.

Cross-border credit information. Because the DCC system offers cross-border credit, cross-scenario and cross currency credit for digital assets, DCC can match values from different loan jurisdictions in various countries, which greatly facilitates the multinational activities of lending agencies . Being more frequently used, DCC is expected to become the anchor currency of the multi-national lending ecosystem on the distributed credit chain and open the value exchange of ecosystem service providers in various countries. With DCC, users in one country or scenario will be able to purchase data reports from data providers in another country or scenario,

The main advantage of the platform

- Decentralization. The DCC project is a living example of the benefits of modern technology in the traditional centralized ecosystem. Many users can only dream of such transparency!

- Registration. Here it is really very convenient, compared to the main competitor.

- High security. In the system you can easily, simply and quickly delete information to avoid problems.

- Returned. And, of course, in this system, any supplier can earn DCC.

Role of DCC Notification

Signed, it is part of the DCCwallet Ethereum category, a popular payment currency that will bring together participants from around the world. It will fulfill the following important functions:

Signed, it is part of the DCCwallet Ethereum category, a popular payment currency that will bring together participants from around the world. It will fulfill the following important functions:

- As every participant in the chain, whether a regular user, a commercial company, a company or a bank agent, has documented reports stored in the chain, it can be purchased for the map. This is useful for analyzing the risks and effects of ongoing situations.

- To pay the card will be the credit agencies need an international certification. It will be their guarantee of equity.

- When clients borrow money, customers pay money when they apply for a consumer loan or other loans. The minimum amount will be specified by the different borrowers. And the more customers who pay, the earlier the application is reviewed and approved. After all, it promotes the development of the ecosystem and chooses itself.

How DCC works

The concept of a distribution bank is to break the monopoly of traditional financial institutions on fair financial returns and financial services revenues to all suppliers and users. , so that each participant has contributed to the development of the ecosystem, can be a comprehensive financial stimulus.

Because of his non-centered thinking, IB will be able to change the paradigm of cooperation in traditional financial services and create a new interactive model with colleagues and all telecom companies. all zones and zones.

As far as business is concerned, IBO is completely transforming its debt structure, assets and intermediary traditional banking services by:

replacing corporate responsibility with the management of distributed capital;

Replace real estate activity with a distributed credit report;

Debt registration and replacement of intermediaries by transaction with distributed assets.

The traditional bank's tree management structure will evolve into a flat structured distribution bank that will establish dispersed standards for different businesses and increase the overall efficiency of the business.

Replace real estate activity with a distributed credit report;

Debt registration and replacement of intermediaries by transaction with distributed assets.

The traditional bank's tree management structure will evolve into a flat structured distribution bank that will establish dispersed standards for different businesses and increase the overall efficiency of the business.

The Fund will implement a core credit supply chain (CDC) to establish business standards, reach consensus on books, conduct commercial contracts, perform payment and payment services, and so on. for various financial transactions distributed.

Future with the Distributed Credit Chain (DCC)

Future with the Distributed Credit Chain (DCC)

So imagine that all banks have already been replaced by a profitable distributed credit chain. This means that the loan does not already mean a long, difficult process with high risks of being cheated - it's just the situation like "when someone needs money - it's not a problem to get them where you want. This is the future where money can help build lives and maintain relationships with someone who wants to lend money and someone who has clear money.

So imagine that all banks have already been replaced by a profitable distributed credit chain. This means that the loan does not already mean a long, difficult process with high risks of being cheated - it's just the situation like "when someone needs money - it's not a problem to get them where you want. This is the future where money can help build lives and maintain relationships with someone who wants to lend money and someone who has clear money.

Thus, the Distributed Credit Chain (DCC) creates the conditions for ruining the obsolete banking system by replacing it with a new effective blockchain decision.

DCC ICO Information

• Token: DCC

• Standard: ERC: 20

• Type: Utility token

• The symbolic cost in ETH: a Token = 0.000073 ETH

• Accepted currencies: BNB and ETH

• Hard cap: 36,500 ETH

• Soft cap: 14,500 ETH

• ICO start: May 28, 2018

• ICO sends: June 28, 2018

• Provision of full chips: 500000000

• Additional Token Issue: No

• Bonus program: Yes

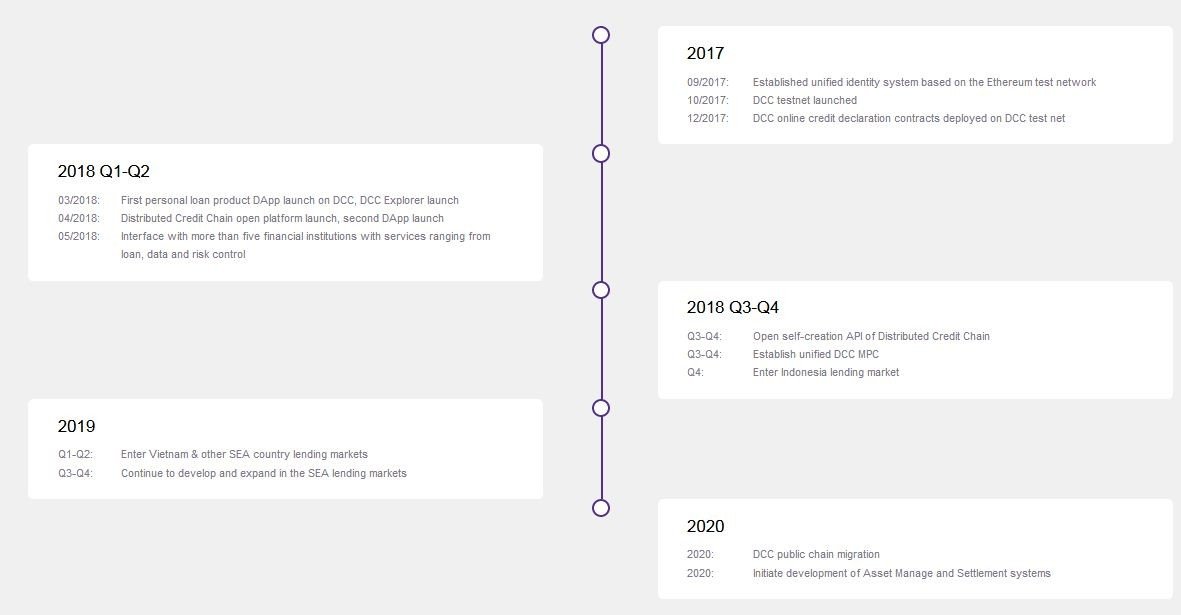

Roadmap

%20rm%20c%E1%BB%A7a%20dcc.jpg)

2017

09/2017: Unified identity system based on the Ethereum test network

10/2017: launch of DCC testnet

12/2017: DCC online credit reporting contracts deployed on the DCC test network

10/2017: launch of DCC testnet

12/2017: DCC online credit reporting contracts deployed on the DCC test network

2018 Q1-Q2

03/2018: Launch of the first DApp personal loan product on DCC, launch of DCC Explorer

04/2018: Launch of the Distributed Credit Chain open platform, second launch DApp

05/2018: Interface with more than five financial institutions with services ranging from loan, data and risk control

03/2018: Launch of the first DApp personal loan product on DCC, launch of DCC Explorer

04/2018: Launch of the Distributed Credit Chain open platform, second launch DApp

05/2018: Interface with more than five financial institutions with services ranging from loan, data and risk control

2018 Q3-Q4

Q3-Q4: Q3-Q4 Distributed Credit Chain Open Self-Creation API

: Establish a Unified

T4 DCC MPC : Enter Indonesia Loan Market

Q3-Q4: Q3-Q4 Distributed Credit Chain Open Self-Creation API

: Establish a Unified

T4 DCC MPC : Enter Indonesia Loan Market

2019

Q1-Q2: Entering Vietnam and other SEA

T3-Q4 loan markets : Continue to develop and expand SEA loan markets

Q1-Q2: Entering Vietnam and other SEA

T3-Q4 loan markets : Continue to develop and expand SEA loan markets

2020

2020: migration of the public channel DCC

2020: Initiate the development of asset management and settlement systems

2020: migration of the public channel DCC

2020: Initiate the development of asset management and settlement systems

Conclusion

In fact, the entire credit distribution chain has huge potential. This model can be applied completely in any part of the financial industry. A team of experts worked on the project, which clearly sees their goals and knows where they should go. So, I recommend that you study the concept of this project in more detail and actively participate in this concept. Because we are closely linked to each day in different financial institutions and do not understand how often they use us, while reaching their own goals. I think it is necessary to change enough to be their puppet, it's time to put an end to it. In addition,

In fact, the entire credit distribution chain has huge potential. This model can be applied completely in any part of the financial industry. A team of experts worked on the project, which clearly sees their goals and knows where they should go. So, I recommend that you study the concept of this project in more detail and actively participate in this concept. Because we are closely linked to each day in different financial institutions and do not understand how often they use us, while reaching their own goals. I think it is necessary to change enough to be their puppet, it's time to put an end to it. In addition,

For more information links:

• Official website - http://dcc.finance

• Whitepaper - http://dcc.finance/file/DCCwhitepaper.pdf

• Facebook - https://www.facebook.com/DccOfficial2018/

• Twitter - https: // twitter.com/DccOfficial2018/

• Telegram - https://t.me/DccOfficial

• Whitepaper - http://dcc.finance/file/DCCwhitepaper.pdf

• Facebook - https://www.facebook.com/DccOfficial2018/

• Twitter - https: // twitter.com/DccOfficial2018/

• Telegram - https://t.me/DccOfficial

Author: Maryatibtc

Profile Bitcointalk:

Profile Bitcointalk:

Eth address :

0x20e8ce56DB99EC437BD8218Ab29595E4289eAC43

Komentar

Posting Komentar